Regulatory Burdens, Barbie and Taylor Swift Impact the Chemical Industry

The U.S. economy is in fairly solid shape, with reasonably good growth projected for the second quarter, driven largely by resilient consumer spending. However, growth in consumer spending is expected to downshift due to higher borrowing costs, depletion of excess savings and narrowing real wage growth, according to Martha Gilchrist Moore, chief economist at the American Chemistry Council (ACC). Moore offered an update on the state of the chemical industry for a Chemical Processing webinar in mid-June. She also mentioned that inflation remains sticky but is showing signs of improvement, with the core consumer price index running at 3.4%. The Fed is taking a cautious "higher for longer" approach, signaling potential rate cuts only after seeing concrete signs of inflation returning to 2%.

Consumer spending remains robust overall but is shifting from goods to services compared to the pandemic era.

“A few years ago, people were spending lots of money on things — dishwashers, exercise equipment, laptops, furniture. Now, people are spending a larger share of their budget on services,” said Moore. “There was a huge rebound, especially last summer. There was Taylor Swift, there was the Barbie movie, travel. People are going places, airplanes are full, people are eating out, but there's also a lot of spending on nondiscretionary items, things like rent and insurance and electricity. And all of these services obviously consume fewer molecules than the spending on goods, and that is one of the reasons that the chemical industry in particular has had a bumpy time.”

Moore tracks 18 end-use industries. Last year, 10 of those industries contracted. For 2024, 2025 and 2026 the prediction is only five of those industries will contract. Semiconductors, aerospace and motor vehicles are performing well. Industries like furniture, apparel and textile mill products will continue to see contraction – as will appliances, due to the housing market (see figure below).

Indeed, housing, an interest rate-sensitive sector, was among the first impacted when the Fed raised rates in 2022. Housing starts declined for two years to 1.41 million in 2022. Only a modest increase to 1.42 million is expected amid persisting high interest rates. The prevalence of 30-year fixed-rate mortgages in the United States exacerbates the impact of higher rates, creating affordability challenges and limiting mobility, though some support comes from new home demand.

ACC’s Economic Sentiment Index, which queries the association’s member companies on their assessment of their U.S. business, showed positive signs, with most members reporting expansion in new orders, production levels and capacity utilization in Q1, despite higher input and labor costs. Capital spending also turned positive. Inventory levels are becoming more balanced after a period of increases. However, regulatory burdens continue rising, with 58% seeing an increase in Q1 and two-thirds expecting further increases over the next six months. After a 1.3% volume decline in 2023 due to destocking, a modest 2.4% gain is projected for 2024, led by basic and agricultural chemicals. Growth is expected to be weaker in consumer products and specialty chemicals tied to uneven manufacturing recovery. Long-term prospects are supported by new manufacturing capacity and positive energy fundamentals. (See figure below).

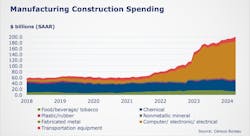

“One of the things that makes me optimistic for the chemical industry going forward is this resurgence of manufacturing in the United States,” said Moore. “We saw during COVID the real supply-chain vulnerabilities of going abroad for all of these materials. So, there's been some domestic reshoring or nearshoring to Mexico.”

Recent legislation is also a source of optimism, according to Moore. Incentivizing sectors like clean tech, infrastructure and semiconductors through legislation like the Bipartisan Infrastructure Law, Inflation Reduction Act and CHIPS Act are bright points. This manufacturing construction boom, particularly in computer, electronics and electrical equipment to support data centers and AI, will drive demand for the 500+ chemicals required in semiconductor production and create opportunities for the chemical industry as this condensed North American manufacturing hub emerges.

“There's been a huge demand recently for data warehousing, and as the artificial intelligence starts to get built out, the amount of electrical equipment required to run the data centers is phenomenal — and all of that requires chemistry,” said Moore. (See figure below).

Related Content

- Current State of the Chemical Industry: Navigating Economic Shifts and Emerging Opportunities

- A Better Year for U.S. Chemistry in 2024?

- Global Chemical Regulations: 2024 Will Be a Consequential Year

- Navigate Chemical Supply Chain Disruptions

- Sustainability: Chemical Clusters Drive Green Hydrogen, Carbon Capture and Circular Economy Solutions

- Compliance: What to Watch for in 2024

- Chemical Processing Notebook: Bracing for the Regulatory Onslaught

- Chemical Processing Notebook: Reshoring Critical Chemical Production to Fortify U.S. Supply Chains

- EPA Tightens Grip on Toxic Chemicals, Industry Feels the Heat

What Keeps ACC’s Economists Awake At Night?

“I think first and foremost is this regulatory overreach by the Biden administration,” said Moore. “The chemical industry is clearly in the crosshairs, they are publishing all kinds of rules specifically for the chemical industry and other rules that involve industry more broadly, but impact our members as well.”

Another thing that worries the ACC is the Fed making a mistake.

“Jay Powell [Jerome Hayden "Jay" Powell, chair of the Federal Reserve] is making clear that he's going to keep rates higher for longer, but they need to start cutting at an appropriate time,” said Moore. “I get that they don't want to repeat the mistakes of Paul Volcker [former Federal Reserve chair 1979-1987] in the 80s, but if they keep interest rates too high for too long, that can be detrimental to the economy.”

Additionally, things like supply chain risk are worrisome. “We've seen these rerouting of shipments around the Red Sea,” said Moore. “There's all sorts of geopolitical instability in parts of the world, ongoing war in Ukraine, ongoing conflict in Gaza and Israel. And there are other places in the world where conflict could arise. Everybody's keeping an eye on South China Sea. Things like hurricanes, that's certainly a risk to production levels, certainly along the Gulf Coast and those basic chemical segments and the businesses that they sell into.”

And finally, things like cybersecurity and financial volatility, could be disruptive as well.

Election Impact on the Business of Chemistry

“There are two very different landscapes ahead, depending on the outcome of the election,” said Moore. “We saw that the [China] 301 tariffs that came in during the Trump administration, Biden has actually extended some of those recently. There's an increasingly protectionist bent in Washington regarding trade, whether you're a Republican or a Democrat. So I don't see huge amount of rollback in protectionist trade policies under either administration. I would anticipate that the Trump administration would take an even further hard line on trade.”

Moore also noted that there are a number of tax provisions that expire at the end of 2025 that were put in place during the Trump administration. So, depending on who is in the White House, those could either get extended or changed or rolled back.

Aging Population and the Middle-Class Impact

“Chemical demand is a function of what people are doing, and the number of people and what they're consuming is important,” said Moore. “In the United States, we've got an aging population and the consumption of consumer spending is different for older people than it is for younger populations. So, globally speaking, the largest growth in chemical demand will probably be in some of those growing emerging markets where you're adding millions of middle-class consumers to those economies. Middle-class consumers consume quite a bit of chemistry. They're coming from a very low level, and suddenly they're buying their first appliances, their first motor vehicle, housing. There's just a lot of molecules associated with moving folks from a lower standard of living to that middle-class standard of living. And that's really going to drive demand for chemistry going forward.”

About the Author

Traci Purdum

Editor-in-Chief

Traci Purdum, an award-winning business journalist with extensive experience covering manufacturing and management issues, is a graduate of the Kent State University School of Journalism and Mass Communication, Kent, Ohio, and an alumnus of the Wharton Seminar for Business Journalists, Wharton School of Business, University of Pennsylvania, Philadelphia.