Despite the challenges posed by the pandemic, global supply chain issues, and adverse weather events on the Gulf Coast, the American chemical industry expanded in 2021 — although the latter two factors did constrain production. A post-lockdown surge in spending boosted demand for chemicals and other goods and materials. The rebound in demand swept across many chemicals-intensive end-use markets driven by excess savings, stimulus, and shifting demand patterns toward goods.

Now, supply chain bottlenecks appear to be easing, and momentum is rising as manufacturers resume work and rebuild inventories. While risks remain for the global economy, the U.S. chemical industry is in a strong position going into 2022.

However, growth momentum has moderated, as the Delta variant of COVID-19 continues to spread and the Omicron variant raises new concerns, supply chains remain tangled, and inflation accelerates. The low vaccination rates in many emerging markets make these markets vulnerable to the ongoing and ever-changing pandemic. Manufacturing worldwide still is expanding but faces headwinds from supply chain disruptions, transportation bottlenecks, and labor shortages. Global trade volumes, which had rebounded sharply at the beginning of 2021, have eased. Bottlenecks at ports and shortages of shipping containers are factors as is lower production of certain categories of goods, e.g., motor vehicles and parts affected by shortages of semiconductors.

In the United States, the recovery that began in April 2020 continues to expand. However, activity in the third quarter markedly decelerated compared to growth in the first half of the year because supply couldn’t keep up with demand. Now, supply and demand slowly are realigning. Port backlogs are starting to clear, and the strong job market will pull more people into the labor force. Higher employment will offset the removal of federal stimulus, and support continued strong levels of consumer spending. Many indicators now point to continued expansion into 2022.

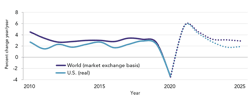

American gross domestic product (GDP) expanded by 5.6% during 2021, compared to a 3.4% contraction in 2020 (Figure 1) but should ease to 4.2% this year. Tempered by the continuing health crisis and supply chain disruptions, the global economy continues to recover but its growth also should slip, from 5.7% in 2021 to 4.4% in 2022.

Figure 1. U.S. and global GDP both will grow moderately through 2025. Source: American Chemistry Council Year-End 2021 Situation & Outlook.

End-Use Markets

Of the 18 chemicals-consuming end-use markets the American Chemistry Council (ACC) tracks, 17 of them posted growth in 2021, some by double digits. However, global supply chain challenges, in addition to weather-related disruptions along the Gulf Coast, muted expansions. Export markets, which bounced back early in the year, softened as ongoing Covid-related upsets and tangled supply chains dampened trade volumes worldwide. Despite these constraints, industrial production rebounded by 5.5% in 2021 and should increase by 4.0% in 2022.

Light vehicles represent an important market for chemicals (more than $3,200 per vehicle). Demand is surging but ongoing shortages of semiconductors are hobbling production. Due to lack of supply, U.S. sales totaled only 15.3 million vehicles in 2021 (compared to 17.0 in 2019) and should rise to 16.0 million in 2022 as supply chain constraints are expected to continue this year.

Housing also is a large consumer of chemicals. Housing starts rose during the pandemic as historically low mortgage rates and remote work and learning led to a geographic dispersion of households away from city centers. In 2021, starts grew to 1.58 million (the highest number since 2006). While employment and income growth as well as household formation (a key driver of housing demand) remain strong, constraints on building materials, land use, and labor, in addition to growing affordability challenges, will curb growth in the short-term. Housing starts should ease slightly to 1.56 million in 2022 and 2023.

Industry Outlook

The U.S. chemical industry expanded in 2021 on the back of the global post-lockdown rebound. However, while strong consumer demand for goods set the stage for robust gains in U.S. chemical production, weather-related disruptions hobbled production. For instance, February’s icy temperatures along the Gulf Coast caused widespread power outages and freeze damage that knocked out a wide swath of chemical and other industrial capacity. Texas was especially hard hit — with outages persisting for months at some facilities. These disruptions led to shutdowns or reduced-capacity operation at some facilities in other parts of the country that depended on raw materials from the Gulf Coast, resulting in a severe contraction in chemical production during the first half of 2021. Then at the end of August, Hurricane Ida made landfall in Louisiana as a destructive Category 4 hurricane, causing extensive damage to chemical facilities in the nation’s second largest chemical producing state, curtailing capacity for many basic chemicals (including the vinyls’ supply chain) for more than a month.

External supply chain issues in key end-use markets also contributed to softer demand for some chemicals. For example, the slowdown in global vehicle production due to a shortage of semiconductors depressed demand for chemicals, e.g., engineering resins, coatings, etc., tied to that sector.

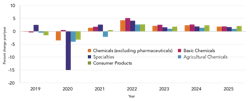

Following a 3.5% contraction in U.S. chemicals production in 2020 and despite multiple challenges in 2021, chemical production (excluding pharmaceuticals) rose by 1.4% last year (Figure 2). As the recovery continues to build and end-use and export markets strengthen, chemical output should rebound by 4.3% in 2022 as inventories are rebuilt and demand in end-use markets continues to firm. As supply and demand move back into balance and growth in end-use markets stabilizes, production growth for U.S. chemistry should average a little over 2% between 2023 and 2025.

Figure 2. Basic chemicals production will pace growth in the U.S. chemical industry for the next several years. Source: American Chemistry Council Year-End 2021 Situation & Outlook.

Due to weather-related disruptions, capacity utilization fell to 80.7%. A slower pace of capacity growth and stronger demand will push operating rates up through 2025.

U.S. basic chemicals (inorganic chemicals, petrochemicals, plastic resins, synthetic rubber, and manufactured fibers) continue to enjoy a competitive advantage due to the relative price of natural gas-based feedstocks. Despite strong demand, weather-related disruptions shaved several percentage points off growth in 2021. Within basic chemicals, inorganic chemicals (including industrial gases) was the highest performing segment with 2.8% growth in 2021. Bulk petrochemicals and organic intermediates grew by 1.7%. Plastic resins production, which increased by 5.6% during 2020, edged higher by 0.4% in 2021. Production of synthetic rubber and manufactured fibers rebounded strongly in 2021, up by 5.1% and 4.6%, respectively.

Meanwhile, the rebound in end-use industries pushed specialty chemicals production up by 2.6% in 2021, with growth across a wide range of functional and market segments.

With tailwinds from restocking and a resolution to supply chain imbalances, growth in basic and specialty chemicals production should expand in 2022, with basic chemicals output increasing by 5.1% and specialty chemicals rising by 4.1%. After 2022, growth rates should moderate through 2025.

The inventory-to-shipment ratios for chemical manufacturers, a key indicator of inventory management, rose sharply during the pandemic and then eased through the second quarter of 2021 as strong demand and supply disruptions lowered inventories across many product chains. Now, inventories remain relatively tight but are more balanced than previously. Along the value chain, downstream wholesalers saw some of the same inventory dynamics, although wholesale inventories remain quite tight. The same holds true for customers further downstream.

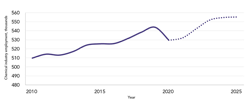

Following a steep contraction in 2020, U.S. chemical industry employment rebounded in 2021, although this was tempered somewhat by weather-related production curtailments. The industry gained a net 2,500 jobs in 2021, bringing employment to 532,000 (Figure 3). Stronger momentum in 2022 will result in another 10,000 jobs. Chemical industry employment should surpass its pre-Covid levels in 2023. Chemical workers continue to be among the highest-paid in the manufacturing sector (averaging more than $90,000 in 2020), and those earnings support local communities.

In response to a need to conserve cash flow amid the pandemic-related downturn, many companies delayed or extended projects. As a result, chemical industry capital spending fell by 17% in 2020. With the resumption of investment activity, capital spending rebounded in 2021, up 14% to $31.2 billion.

Figure 3. Jobs at American chemical plants will rebound and reach record levels. Source: American Chemistry Council Year-End 2021 Situation & Outlook.

Investments in capacity directly related to the U.S.’s competitive advantage due to abundant natural gas resources will slow from the average 11% per year gain between 2011 and 2019. Going forward, capital spending should average 3.7% through 2025.

By 2025, U.S. capital spending by the chemical industry (including foreign companies building American capacity) will exceed $36 billion, nearly three times the level of spending at the start of this last cycle in 2010. Capital spending for bulk petrochemical and organic intermediates as well as plastic resins will dominate. Increasingly, investments in decarbonization technologies and advanced recycling will account for a growing share of capital spending budgets.

More than 350 new chemical production projects, valued at more than $208 billion altogether, were announced through late-November 2021 — with nearly two-thirds complete or currently under construction. Some 69% of these are foreign direct investment or include a foreign partner. Basic olefins capacity could expand another 20% over the next decade. The chemical industry continues to account for more than 40% of new manufacturing construction despite the industry’s 15% contribution to manufacturing value-added.

Tax provisions in the Infrastructure and Investment and Jobs Act recently signed into law as well as proposals for further legislation add uncertainty to the future environment for chemical producers. In addition, continued constraints on trade threaten access to global supply chains and export markets.

Global Perspective

Vulnerabilities in supply chains increasingly have surfaced since the pandemic began. In 2021, transportation networks struggled to move goods and some materials became difficult to source. On a worldwide basis, trade volumes, which fell 8.2% in 2020, bounced back strongly at the beginning of 2021 as demand recovered. Global trade volumes grew 8.5% in 2021.

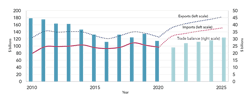

In the United States, both exports and imports of chemicals rebounded strongly in 2021 (Figure 4), although the pace of improvement slowed in the second half because of port delays and other upsets to logistics. Due to the relative strength of the U.S. economy and the impact of production disruptions, export growth lagged import growth in 2021. Exports hit a record $151 billion while imports rose to $127 billion, resulting in a trade surplus of $24 billion, down from $28.6 billion in 2020. The feedstock-advantaged basic chemicals segment accounted for the majority of the American chemical industry’s trade surplus last year and will through 2025. Exports should rise 7.3% in 2022 to $162 billion and imports should grow 6.3% to $135 billion, resulting in a trade surplus of $27 billion. By 2025, U.S. exports should reach $182 billion.

Figure 4. The U.S. chemical industry’s trade surplus will recover and reach pre-pandemic levels. Source: American Chemistry Council Year-End 2021 Situation & Outlook.

By segment, basic chemicals — in particular, bulk petrochemicals, organic intermediates, and plastic resins — will continue to drive U.S. chemical exports due to the ongoing competitive advantage afforded by shale gas. Exports of specialty chemicals also should grow as global end-use markets recover.

Continued progress on reducing tariffs and other trade barriers is essential to create an environment where the U.S. chemical industry can maximize its competitive advantage and serve customers throughout the world.

As the world economy rebounded in 2021, demand for goods soared and global industrial production climbed by 7.2%. As most chemical markets are tied to industrial production, demand for chemical products also rose strongly, with overall global chemicals output up by 5.8%. Performance among regions varied: the Asian Pacific region posted 8.2% growth; output in Eastern Europe and the Former Soviet Union (FSU) countries rose 5.9%; Western Europe saw a gain of 5.3%; Latin American production grew by 4.9%; Africa and the Middle East, which performed relatively well during the pandemic, showed a 2.5% rise; and North America came in with only a 1.8% increase due to weather-related production outages along the Gulf Coast.

Because of ongoing supply chain disruptions during 2021, some chemical production that might have occurred last year may take place in 2022. Growth in chemical output will remain above trend this year, up by 3.8%, before slowing to a 3.2% pace in 2023 and continuing at that level through 2025. The Asia Pacific region with its many large dynamic economies boasts the brightest prospects. The feedstock-advantaged and fast growing chemical industry in Africa and the Middle East also should expand strongly as should the growing economies of Eastern Europe and the FSU countries. Chemical production will continue to bounce back in Latin America and Western Europe, although the pace of the rebound will slow in the years ahead. With a continued feedstock advantage and recovery from outages that disrupted production in 2021, chemical production in North America should accelerate this year before tapering toward trend growth through 2025.

Capacity continues to expand and, with higher production during 2021, global capacity utilization tightened to 82.3%, up from 80.3% during 2020. Below-normal capacity utilization should continue over the next several years. However, with strengthening production volumes, global capacity utilization should improve in the years ahead.

Going into the end of 2021, the chemical industry continued to recover from the lockdown-induced recession in 2020. As demand for goods has rebounded in the United States and the rest of the world, so, too, has demand for chemicals. With its comparative advantage from abundant energy resources, the American chemical industry is uniquely situated to meet global demand. This year, U.S. production of chemicals is poised to accelerate as strong consumer demand and restocking drive growth. An easing of shipping bottlenecks will positively impact trade as well.

New feedstock-advantaged capacity that has come online in recent years puts the U.S. in a top competitive position through 2025. As the global economy continues to rebound and key end-use industries expand, basic and specialty chemicals should see solid growth. Continued investment in U.S. chemical manufacturing will enable the industry to meet growing global demand and enhance sustainability through decarbonization projects and advanced recycling. Already a leading employer, the chemical industry will expand its workforce, supporting local communities. To achieve these ambitious goals, the industry needs export markets to remain open and continued support of U.S. energy development, in addition to a sensible approach to regulation and taxation.

Significant risks to this outlook include, most prominently, the management of the pandemic. At press-time, a surge in infections from more-recent variants of COVID-19, coupled with steps necessary to deal with them, could markedly alter prospects. In addition, persistent supply chain challenges and systemic inflation, while not anticipated, could create more friction in the global economic system, creating headwinds for the global economic recovery.

MARTHA GILCHRIST MOORE is chief economist and managing director of the American Chemistry Council, Washington, D.C. Email her at [email protected].