Electronic chemical suppliers are expected to rebound from a relatively weak showing in 1998 and early 1999, says a recent report from The Freedonia Group, Cleveland.* Worldwide demand is forecast to grow more than 10 percent per year to $17.6 billion in 2004. In the United States alone, electronic chemicals are projected to increase 8.5 percent per year to approximately $6 billion in 2005, says another Freedonia Group report.**

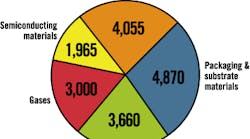

Projected World Electronic

Chemical Demand, 2004 (in $ millions of dollars)

Source: The Freedonia Group Inc.

The technology push

Leading the charge, says The Freedonia Group, is strong growth in higher value, high-performance products such as chemical mechanical planarization (CMP) slurries, compound semiconducting materials, advanced photoresists and specialty gases. These and other products allow manufacturers to increase component density and reduce line widths to meet consumer demand for smaller, lighter and faster wireless communications and computer equipment.

"Growth in the electronic chemical marketplace is, and will continue to be, driven by technology and environmental concerns," says Rich Jahr, vice president, electronics for Air Liquide America Corp., Dallas. "The growth that we are seeing is not due to lack of capacity. Rather, the new technology for the next generation of devices that offer higher speeds and require better heat dissipation, resistance and capacitance delay and electro migration is driving growth. This new generation of devices requires new processes and materials, which are increasingly more complex to develop and introduce to the market."

Specifically, says Joe Stockunas, worldwide marketing director for the electronics division of Air Products and Chemicals, Allentown, Pa., the industry is being shaped by two major advances: 300-millimeter (mm) wafer fabrication and submicron design technology.

"The industry is going from a 200-mm wafer to a 300-mm wafer," says Stockunas. "And that has some interesting implications for us. Bigger wafers and bigger chambers mean more specialty chemicals are being used to etch, to clean and to deposit materials on those wafers. This is also true for the nitrogen requirement. We're seeing a higher demand for nitrogen ," about a 50 percent increase in ultra-high-purity nitrogen for a 300-mm fab vs. a 200-mm fab."

Specialty electronic chemicals also are making an impact as the material set associated with the manufacture of integrated devices changes, states Stockunas. He speculates that this market is growing at a much higher rate than are the bulk chemicals and bulk gases markets.

According to The Freedonia Group's World Electronic Chemicals to 2004, alternative semiconducting materials such as polysilicon, gallium arsenide and indium phosphide will top double-digit gains. Demand for specialty gases also will get a major boost from soaring demand for nitrogen trifluoride in chemical vapor deposition chamber cleaning uses. But chemical mechanical planarization (CMP) slurries are forecast to enjoy the most dramatic growth as CMP processes find more widespread use, particularly outside of the United States, where the technology is now concentrated.

Challenges and issues

The future of the electronic chemicals market is not without its challenges, however. Rich Jahr of Air Liquide cites competition, escalating research and development (R&D) costs, implementation time and environmental concerns as potential roadblocks to success.

"Competition to develop and market these new solutions is fierce," says Jahr. "The need for new technology has shortened the product life cycle. Thus, implementation is crucial as the recovery of R&D costs hinges on the ability of end-users to implement new materials such as copper, low-k dielectrics and new processes such as the integration of low-k and copper."

The industry itself is fragmented as a result of the diverse array of products and applications involved, states The Freedonia Group. However, the upswing in acquisition activity that began in the late 1990s is expected to continue.

"As a new form of competition, we are seeing a move toward both industry consolidation and the development of customer and supplier alliances that will drive new product development that is both cost-effective and environmentally friendly," says Jahr of Air Liquide. "To succeed, companies must pursue cooperation up and down the supply chain ," and industry must be agile in its response to commoditization pressures."

Stockunas of Air Products agrees. "Before, when there were chemical suppliers and gas suppliers, they were separate activities," he says. "Our customers have been looking, for the last several years, for total solutions on materials. And you're seeing consolidation ," the ability to supply both gas and chemicals ," result."

* World Electronic Chemicals to 2004

** Electronic Chemicals to 2005